There is a well-known narrative that compares Europe’s recent economic history to that of the United States. The story goes that Europe enacted too little stimulus spending during the Great Recession of 2008–2009 and then turned to severe spending cuts afterward, triggering a second recession and leaving their economies far behind even the mediocre American recovery. However, not one aspect of the narrative is accurate.

In a recent Heritage Foundation Special Report, Europe’s Fiscal Crisis Revealed, my co-authors and I debunk several of the common assumptions surrounding the European debt crisis. First, the U.S. and European governments exhibited similar spending increases during the height of the economic crisis, 2007-2009. In fact, the double-dip recessions in Europe did not begin in the most austere countries, but instead in the most profligate countries, such as Greece. Second, neither the United States nor most major European economies have implemented particularly austere fiscal policies. Finally, crisis countries aside, Europe’s healthier economies have experienced revivals similar to that of the United States. Since 2009, the American and German economies have grown by 11 percent, the United Kingdom by 8 percent, France by 7 percent, and Sweden by 15 percent. Many “austerity” policies have mostly involved merely the expiration of stimulus spending and temporary tax cuts.

There is not much to be learned from the differences between the U.S. and Europe in policy or economic outcomes because those differences are small. Instead, one can draw lessons from the diverse policy choices and economic outcome among European countries and other developed economies.

Profligate or Austere?

One surprising feature of the data is how difficult it would be to lump countries into “Keynesian” (borrow and spend) or “austere” (tax and cut) categories.

Economists believe that higher tax rates result in lower growth and that government spending results in temporary GDP growth, although it will crowd out the private sector in the long run. In crises like the recent ones, the causal relationships can run in the opposite direction, too: straitened governments are forced into deficit reduction.

Thus, unsurprisingly, GDP growth from 2007 to 2012 is positively correlated with spending and negatively correlated with the revenue rate over the same period. These correlations remain even after limiting consideration to countries that experienced positive GDP growth. One would thus reasonably expect that spending and tax rates are negatively correlated. In a crisis, the story goes, a country is either Keynesian or austere. Much of the familiar narrative is built around this assumed taxonomy.

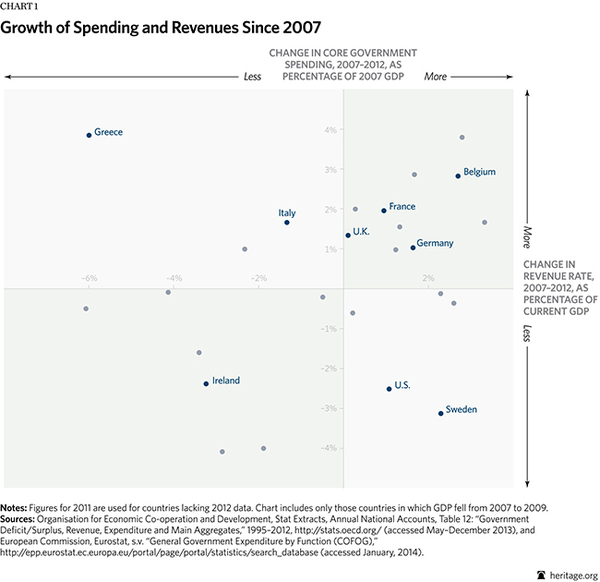

Instead, taxes and spending are positively correlated (0.16) across countries. While there are examples of Keynesian and austere countries, these are the exceptions, not the rule. Chart 1 shows that every combination of fiscal policies has been tried and that the most common combination has been rising taxes and rising core spending. Europe’s three largest economies followed that pattern. Far from cutting government to the bone, most countries in Europe expanded the role of government in the economy.

In addition to the lack of a clear relationship between tax and spending policies, different measures of fiscal policy often give different results. Even in some countries that suffered large crises and made large and decisive policy changes, sources disagree on the magnitudes. And no matter what one’s economic philosophy, no country has been a paragon of good policy.

Austerity Eurozone?

International Monetary Fund (IMF) data on deficit reduction reveals little geographic regularity. The three largest reductions were in Euro members Greece, Portugal, and Ireland. Spain’s budget cuts were similar to those of Romania and Iceland, non-Euro countries that experienced crises. The group of “crisis countries” consists of those that experienced sharp increases in their borrowing costs, reflecting investor worries about their willingness to repay. Most countries that ended up making major cuts did so after their borrowing costs started spiraling upward.

According to the IMF report, the U.S. and Poland had greater deficit reduction than the U.K. and Italy, though the latter are often considered austere and the former Keynesian. The bulk of the Eurozone economy—Germany, Austria, the Netherlands, and Belgium—consolidated by a mere 1 percent of GDP. Finland acted like its non-Euro neighbors Sweden and Denmark in continuing expansionary policy.

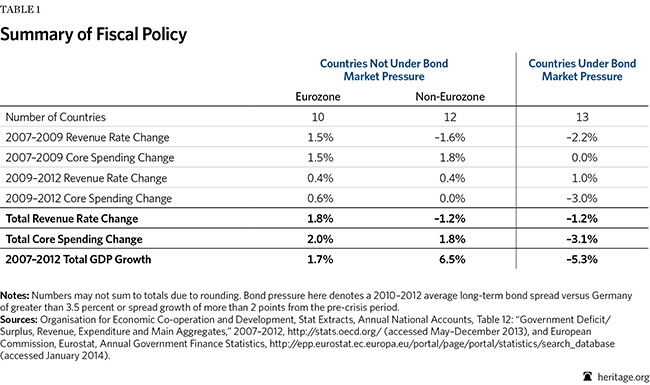

Organisation for Economic Co-operation and Development (OECD) data on government spending also shows that several Eurozone crisis countries significantly cut spending from 2010 to 2012: Portugal, Spain, and Greece reduced spending by at least 3 percent of GDP. But even in the post-recession years, the core of the Eurozone did not decrease spending much. Government spending fell 1.4 percent of GDP in the Netherlands and 0.1 percent of GDP in France, but rose slightly in Austria, Belgium, and Germany. The OECD data is summarized in Table 1.

Outside the Eurozone, spending rose during the recession and then stayed the same on average afterward. Post-recession spending cuts were concentrated in former Warsaw Pact countries.

Revenue changes, however, show that the Eurozone engaged in a general shift toward higher taxation, unlike non-Eurozone countries. Whereas non-Euro countries on average cut taxes during the Great Recession and then edged them back up afterwards, Eurozone countries raised taxes during the Great Recession and continued to raise them afterwards.

During 2007–2012, the 12 non-Euro countries increased spending by 1.8 percent of GDP and cut the revenue rate by 1.2 points on average. The 10 Euro countries increased spending by 2.0 percent of GDP and revenue rates by 1.8 points.

Europe as such has not engaged in severe deficit reduction, although several European countries have done so. Claims that the U.S. economy is outpacing Europe’s due to the former’s lack of austerity are unconvincing. The Eurozone’s steadily rising revenue rates and spending totals distinguish it from the rest of the developed world and from some popular narratives of the Eurozone’s recent history. Explanations for the Eurozone’s economic performance should take the data into account.

Is Austerity Coming?

If serious spending cuts have not yet happened in Europe should observers conclude that the cuts must still come? One interpretation of recent history is that Southern Europe was just a few years ahead in terms of debt, deficits, and unfunded entitlements. But recent history ultimately gives few clues for the future. Long-term fiscal imbalances are driven by entitlements and demographics, not recent shifts in discretionary spending. And the focus on changes in fiscal policy since 2007 obscures large differences across countries in tax and spending levels.

It turns out to be very difficult to accurately measure long-term fiscal imbalances. For example, estimates of long-term imbalance published by the EU are uncorrelated with estimates published by Jagadeesh Gokhale of the Cato Institute. The EU’s estimates change a great deal with each update, indicating that they are sensitive to short-run changes in policy or the business cycle. Thus, although one expects the countries with the greatest fiscal imbalances to face fiscal crises soonest, identifying those countries is not easy.

More importantly, austerity in the midst of a debt crisis is neither the only nor the best way to resolve persistent fiscal imbalances. Several countries have demonstrated that tax reform and moderate adjustments to entitlements can improve growth, decrease obligations, and preserve revenue.

In the Special Report, Romina Boccia chronicles how labor market and unemployment insurance reforms that encouraged work have made the German economy a dynamic leader in Europe again. While most unemployment rates in Europe have drifted higher, Germany’s has fallen from 9 percent in 2007 to 5 percent this year, with only a brief setback during the recession. The German labor market success is a reminder that policy details matter in ways that are not captured by aggregate measures.

Malin Sahlen’s profile of Sweden in the Special Report shows that even in a major depression, such as Sweden’s in the early 1990s, structural reforms are possible. The well-known strength of the modern Swedish economy owes a great deal to tax reform and budget discipline enacted at the bottom of a major crisis.

Just as the Great Recession and debt crisis of 2007-2012 did not provoke a unitary response across Europe, future deficit cuts are likely to transpire piecemeal. When opportunities for deficit reduction and structural reform arise, however, we do know which approaches are most likely to succeed in curbing debt and encouraging growth.

Deficit Reduction and Growth: Historical Evidence

One of the main lessons of the scholarly literature on deficit reduction is that it is a mistake to lump together tax increases and spending cuts. In the Special Report, Alberto Alesina and Veronique de Rugy review the last two decades of academic writing on deficit reduction, which they term “fiscal adjustment”:

[Economists] seem to have recently reached a consensus that spending-based fiscal adjustments are not only more likely to reduce the debt-to-GDP ratio than tax-based adjustment, but also less likely to trigger a recession. In fact, if accompanied by the right type of policies—especially changes in public employees’ pay and public pension reforms—spending-based adjustments can actually contribute to economic growth….

However, it is important to refrain from oversimplifying these results because fiscal adjustment packages are often complex and multiyear affairs. Many successful (i.e., expansionary and debt reducing) fiscal adjustments in this literature are ones in which exports led growth when the rest of the global economy was healthy or even booming. While there has been some recovery in the midst of the recession, we should recognize that achieving export-led growth may be much harder today when many countries are struggling.

While austerity based on spending cuts can be costly, the cost of well-designed adjustments plans will be low…. [T]he alternative for certain countries could be a very messy debt crisis.

Presenting research at The Heritage Foundation in October 2013, Daniel Leigh of the IMF showed that he and his colleagues estimate that tax-based deficit reductions lead to three or four times as much decline in consumption and gross domestic product as spending-based deficit reductions.

Of four recent scholarly papers that estimate the growth effects of both taxes and spending over several years, three found that taxes have a stronger impact on the economy and one had ambiguous results. There is a growing body of evidence that increasing government spending does little good and cutting it does little harm.

Deficit Reduction and Growth: Recent Evidence

The evidence from fiscal policy over the past five years tends to confirm the main finding of the literature: Deficit reductions by cutting spending are much less harmful to growth than tax-based deficit reductions. However, a single episode should never be over-interpreted, and this is no exception.

Because total deficit cuts (as measured by the IMF Fiscal Monitor) were uncorrelated with the composition of deficit cuts (spending versus taxation), it is at least reasonable to look for differential effects of taxes and spending on growth. When using a straightforward regression analysis, one discovers that one dollar of tax increases was associated with two dollars less GDP in 2012, and one dollar of spending cuts only decreased GDP by 70 cents. Furthermore, there was no correlation between government spending and private-sector GDP, as seen in Chart 2.

Using another approach, a country that relied on tax increases for 80 percent of its deficit reduction had grown 3.1 percentage points less than a country that relied on spending cuts for 80 percent of its deficit reduction. The estimated effect is large, but it is also imprecise.

Conclusion

The best alternative to austerity is for governments to run national finances soberly. Small surpluses during good times and modest deficits during recessions allow future generations of voters the opportunity to govern themselves as they choose, opting and paying for the government of their choice.

If Europeans choose to expand government and raise taxes, history shows that they can expect fiscal conditions to worsen and high unemployment to ensue. By contrast, deficit reduction based on tax reform, liberalizing labor markets, narrowing welfare and pension benefits, and cutting spending offer a reasonable chance of rapid recovery and fiscal balance.

Salim Furth Ph.D. is a Senior Policy Analyst for the Institute for Economic Freedom and Opportunity at The Heritage Foundation. A version of this article originally appeared in two Heritage Foundation publications: Europe’s Fiscal Crisis Revealed: An In-Depth Analysis of Spending, Austerity, and Growth and Stimulus or Austerity? Fiscal Policy in the Great Recession and European Debt Crisis.