Israel’s kibbutz movement was certainly important – and more than that, prominent – but, contrary to conventional wisdom, it was never a central force in the Israeli economy.

The 1980s in Israel

The roots of economic change in the kibbutz movement can be traced to the mid-1980s. Israel had a major problem. There was dangerous deterioration in all economic parameters, and it reached the second most difficult economic crisis in its history. (The first came with the establishment of the State.)

The seriousness of the situation could be understood from the rate of inflation, which reached 445 percent in 1984. The difficult situation of the economy further exacerbated a crisis that erupted in 1983 with the collapse of Israeli bank shares. The government undertook to cover a large part of the expected losses. To this end, it transferred to itself the ownership of most of the commercial banks and became the guarantor of a large part of the public’s investments in their shares.

The unsurprising result was an increase in the government’s internal debt. Israel’s government already was involved in every aspect of the economy. Public expenditure reached a peak of 76 percent of GDP, and most of the large companies were owned by the government as well.

The high inflation resulted in a very large deficit in the state budget and the balance of payments accounts. Debts rose to such a level that there was a fear of national bankruptcy. In June 1985, the politicians decided that the direction must be changed dramatically. That is how the “Economic Stabilization Program” was born and the government began a process of self-reduction. Thirty-four years later, Israel’s government involvement in the economy is one of the lowest in the Organization for Economic Cooperation and Development (34 democracies with market economies).

Economic Stabilization

Behind the stabilization plan was a national unity government that took office in July 1985– representing parties from the left to the right – and managed to deal with various pressure groups. The main points of the plan were a deep cut in the state budget, a wage freeze, a freeze on prices of goods, cuts in subsidies and fixing the dollar exchange rate.

In addition, Israel received generous aid from the United States, some of whose senior economists were sent to Israel by the Reagan administration to accompany and help formulate the plan, as well as pressure the heads of government to take the painful steps to ensure that such a crisis did not recur.

The program took advantage of one the main characteristics displayed by Israel since its inception—the ability to act in situations of no choice. The results of the plan were primarily containing inflation, improving the government’s budget deficit and the debt-to-GDP ratio. The program was exceptionally successful and became a model for other countries.

Privatization and Immigration

At the same time, as part of the plan, and in order to generate additional revenues for the State, a very broad privatization of government companies took place. The process was intensified following a global wave of privatization led at the time by Great Britain and other countries.

However, efforts to revive economic growth failed. Israel remained in an economic depression, exacerbated by the lack of continuity and reluctance to further reduce public expenditures, and by a significant increase in interest rates to ensure that inflation did not return. Renewed growth came only in 1989 when the Israeli economy grew by some 20 percent in a short time, following the massive wave of immigration from the Soviet Union.

The program was a turning point in Israel’s economic system, which gradually shifted from a clearly social-democratic policy to a policy characterized by a more liberal and capitalist focus.

There were casualties. In particular, the Histadrut was hurt. It was Israel’s largest and most powerful labor union, which at the time included most public sector workers. Cancellation of various government subsidies granted to it exposed the Histadrut factories’ inability to compete in a free market and its failed management, the product of years of regulated economic certainty. Histadrut factories were forced to take loans and went into a whirl of debt. A cut in Histadrut’s power and a dramatic cut in the defense budget were probably the most important structural changes in the long term.

Another important sector that was hurt was that of the kibbutzim.

The Kibbutz Movement Changes

Kibbutzim (originally collective agricultural and industrial settlements), whose members helped so much in the establishment and defense of the country, were always a small fraction of Israeli economy and population, never exceeding a few percent. Nevertheless, their influence had always been significant.

The movement began long before the establishment of the State and the aura surrounding the builders of the kibbutzim was justified. Many of them sacrificed greatly for the people and the homeland. However, in many ways a kibbutz functioned as an economic mechanism along the lines proposed by many communes: “From each according to his or her abilities and to each according to his needs.” Such a mechanism works when all members participate as self-sacrificing idealists, but collapses when participants seize openings to function as exploiters or parasites or grow frustrated at the denial of individual opportunity and reward.

The increasing importance of professional knowledge and technology in economic development, and the fact that in Israeli society the status of the individual became more important than the collective, both in social and legislative terms, caused a loss of public prestige for the kibbutz idea. As a result, the status and political power of the kibbutz movement weakened. The change of political power in 1977 with the election of Israel’s first right-of-center government strengthened this trend. Nevertheless, few kibbutzim made a real effort to adapt themselves to the changing reality.

Over the years, many kibbutzim had accumulated large debts and found it difficult to pay them. Political control by the socialist Labor movement (HaAvoda), which had roots reaching to the establishment of the State, had given them assurance that the government would be the guarantor of those debts and would take care, in one way or another, of their repayment. Considering this understanding, many mutual guarantees were signed, in which each kibbutz was the guarantor of debts of all others. This gave the financial system the feeling that it would be possible to overcome any future crisis for the kibbutzim.

Yet many kibbutzim became insolvent and in 1989 and 1996, the Israeli government, the banks and the kibbutz movements signed two debt arrangements designed to solve the crisis. This became a major catalyst for the process of change that many kibbutzim have undergone since the 1990s.

At first these arrangements created a rigid economic system and led to a long period of stagnation in the members’ personal standard of living. But the debt arrangements, accompanied by control and supervision by the banks, eventually led to economic reforms that enabled kibbutzim to improve their business performance. Many of the kibbutzim that held industrial plants under the exclusive management of kibbutz members now recruited private capitalists as partners and hired professional managers. Decision-making began to shift to representative and technocratic bodies with the personal involvement of kibbutz members greatly reduced. Some members were asked to go to work outside the kibbutz and some were given the opportunity to develop business initiatives.

Immigration from the former Soviet Union

Economic studies have found that highly educated immigrants are a net positive for many countries, helping them to high rates of growth. This has happened in the United States, Canada, Australia, and in Israel as well.

A huge wave of olim (immigrants) began coming from Russia and Ukraine with the breakup of the Soviet Union in 1989. This changed the face of the country, and in some ways was like the arrival of the cavalry rescuing a besieged Wild West outpost. This phenomenon was quick to make the general public forget the troubles of the kibbutzim.

The vast majority of immigrants quickly integrated into the work force, and within a few years, participation in the labor force by recent immigrants was higher than that of veteran residents. New civilian engineers staffed large parts of Israel’s construction industry. Many other new immigrants with scientific or technological backgrounds greatly helped develop the high-tech industry.

Encouraging Private Investment

Another measure that greatly helped was the government’s Yozma program. Implemented in 1993-1998, it was designed to encourage the growth of the high-tech industry with money invested from venture capital funds. The government directly invested $100 million in 10 venture capital funds. Then the funds could choose to turn the government into a partner or return to the government the amount it invested plus interest. The government initially held 40 percent of each fund, but allowed the private partners to buy its share on favorable terms after five years. Although the investment was not large, it was an encouraging signal, which gave a significant boost to Israel’s venture capital industry and created a climate that encouraged investments in Israeli high-tech.

Within seven years, the population grew by about 25 percent from 4.4 to 5.5 million, with 80 percent of this growth due to the arrival of olim. In the modern era, no other country absorbed such a large percentage of immigrants in such a short period of time. In this, too, economic aid from the United States greatly supported this success.

Yet the relative suddenness of this wave and its widespread scope soon led to a severe shortage of housing and a drastic rise in house prices. That, in turn, led to social protest that subsided only slowly.

Four advantages and three revolutions

Since the beginning of the 21st century, Israel’s economy has been very different from what came before, based more than any other country on high-tech.

The high-tech industry grew out of the universities and military research laboratories that helped create an excellent human and technological infrastructure that served as a springboard. Success stemmed from a unique combination of the maturation of educational and technological products, civil applications of the defense industry, and government assistance in raising venture capital—which later became private—along with immigration from the former Soviet Union that brought in a large pool of talented engineers. Global shifts from hardware to software opened chances for thousands of Israeli companies to break out and show a significant comparative advantage in the global technology market.

It should be noted that Israel always placed emphasis on scientific research and human development, in part as a response to its lack of natural resources and in response to the long-standing Arab League economic boycott.

Israel is the world leader in research and development as a percentage of GDP, also ranking first in the world in the number of start-up companies (about 7,500), fifth in the world in patents per capita, and ranked third in the world by the number of engineers per capita. More than 300 major international companies operate R&D centers in Israel. These includ Facebook, Microsoft, IBM, Intel, Google, Apple, Cisco, Motorola, Philips, Applied Materials, Johnson & Johnson, Siemens, Citibank, HP and EMC. More than 90 Israeli companies are listed on the NASDAQ stock exchange, most of them high-tech.

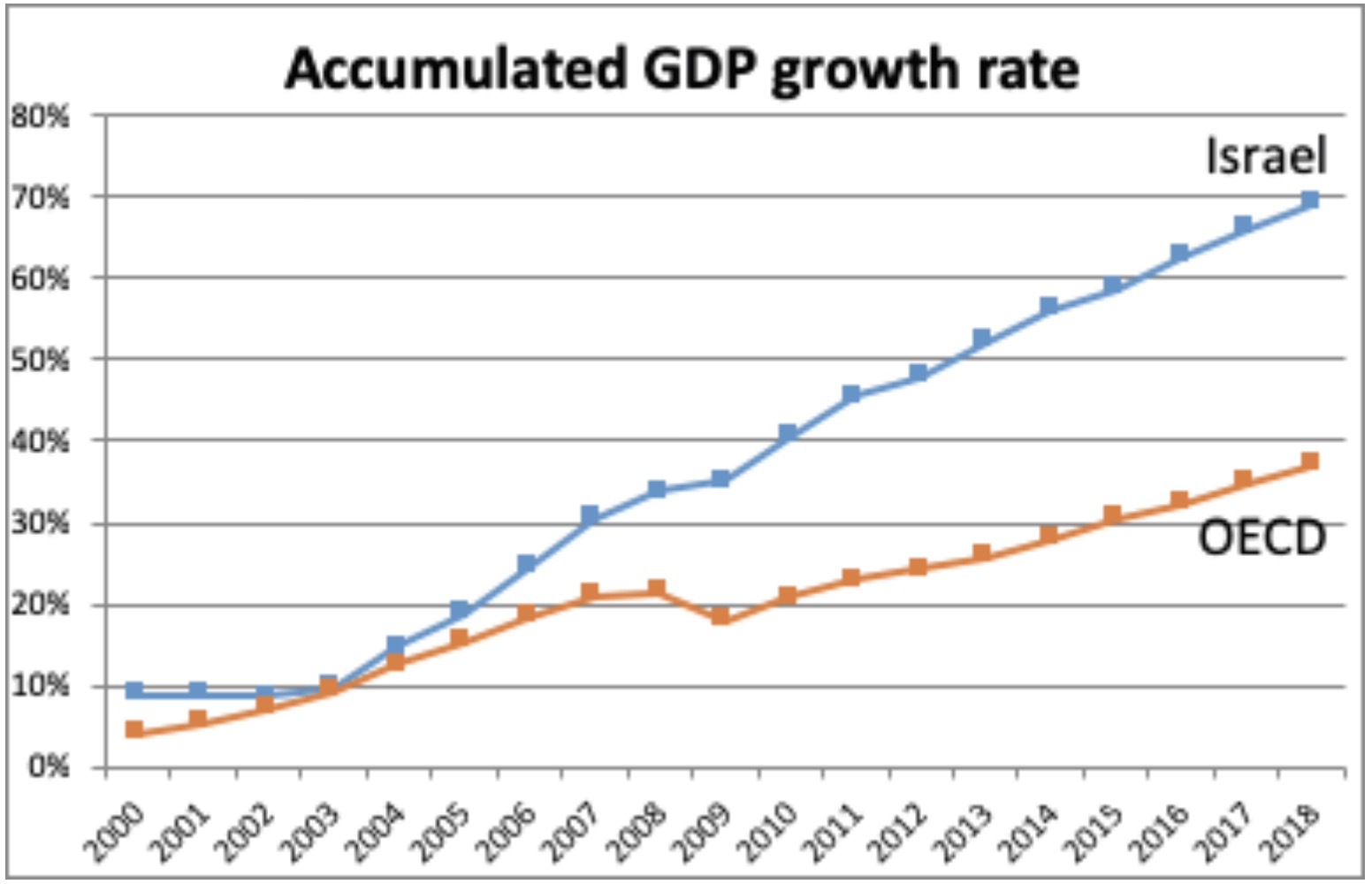

Graph 1 shows the cumulative growth rates of the Israeli economy; almost double that of the OECD countries, since the beginning of the century:

It’s not all high-tech. In our book, Israel – Island of Success, published by Amazon in 2018, Noga Kainan and I found, after a long-term study, four great advantages and three revolutions in the making.

• Technological and Scientific Advantages that are quite clear.

• Entrepreneurial Advantage—the second largest number of entrepreneurs in the world relative to the size of population.

• Global Advantage—ties in other countries, understanding of many cultures and languages, and the connection among Jews around the world—all of these are very helpful for Israeli exports.

• Demographic Advantage—the youngest population in the OECD, which is most important for continued economic growth and high consumer demand, the third-most educated population in the world, and waves of highly educated immigrants.

We also have marked three revolutions of great importance:

• Gas Revolution – the discovery of huge natural gas reservoirs will transform Israel from an importer to an energy exporter and generate high revenues.

• Water Revolution—Israel operates some of the largest desalination plants in the world and almost all urban water consumption comes from these facilities. Israel’s also the world champion in the return of treated wastewater; this helps prevent the phenomenon of desertification.

• Transportation Infrastructure Revolution derived from massive investments.

From its modern start in the socialist labor movement of the 19th century, Israel has the assets and the infrastructure to continue to grow faster than other OECD countries well into the 21st century.

Adam Reuter is chairman of Financial Immunities and co-author of Israel – Island of Success.