Several years ago, I was invited to speak at a panel discussion on energy investing. The audience was comprised mostly of seasoned investors with little interest in environmental issues or anything that even hinted of being “green.”

But as I told the audience back in 2005, investing in clean energy should not be confused with environmentalism. After all, investing in green stocks is not about polar bears or community gardens. It is simply about profiting from one of the biggest energy transformations our world has ever seen. And that’s the reason—perhaps the only reason— every investor should have a percentage of his or her portfolio dedicated to clean energy stocks.

Clean Energy Returns

Those who heeded this advice a few years back made a lot of money before the 2008-2009 recession. Past clean energy winners included:

- First Solar (NASDAQ:FSLR)—1,136% gain in less than 2 years.

- Ormat Technologies (NASDAQ:ORA)—161% in less than 2 years.

- Vestas Wind Systems (CPH:VWS) – 636% in 2.5 years.

- SunPower Corporation (NASDAQ:SPWRA)—457% in 14 months.

- U.S. Geothermal (AMEX:HTM) – 403% in one year.

And despite the current recessionary challenges, clean energy stocks have continued to deliver for investors in 2009. This is a trend that will not end anytime soon.

Peak Energy

The rise in clean energy stocks is inextricably linked to the fact that our current energy sources are dwindling. Indeed, the world is now facing one of its most serious energy challenges: peak energy.

Between now and 2025, we could see the peak of every single one of our finite fuel resources. After the peak, we could witness the rapid decline of these fuel reserves, leaving us vulnerable to what could amount to the biggest disruption the global economy has ever witnessed.

If there was ever a reason to believe in the future profitability of renewable energy, it’s peak energy. These energy sources (wind, solar, etc.) will never be held hostage by fossil fuel depletion.

Fears of Climate Change

The fear stemming from scientific theories surrounding climate change is also proving to be a major catalyst for the growth and rapid integration of clean energy technologies. Whether or not you believe in climate change is irrelevant. It has become part of our daily discourse. And as this climate change juggernaut continues to dictate global policy in the future (and don’t think for a second that it won’t), it is completely illogical for investors to shrug off the potential to make money by buying shares in clean, renewable energy.

There is no getting around the fact that clean energy integration is the way most companies are transitioning away from the carbon-heavy power generation we use today. Investors are often surprised to learn that last year clean energy technologies actually overtook fossil fuels in attracting new investment for power generation. Indeed, even as credit and project financing dried up amidst the recession, energy efficiency and other clean energy technologies attracted more than $155 billion in 2008, while investment in gas and coal came in at about $110 billion.

And this was before the United States and China committed billions of dollars in support for the industry. Currently, $16.8 billion of President Barack Obama’s stimulus package has been set aside for clean energy development, and there’s likely to be even more set aside in future energy legislation. For its part, China is moving forward with a plan that will funnel anywhere between $440 billion and $660 billion into clean energy over the next ten years.

Investing Where Governments Do

With two global powers pumping billions of dollars into clean energy development, global clean energy investment is expected to accelerate in the fourth quarter of 2009—particularly after the first round of stimulus funding makes its way through the system. But this is just the beginning. According to analysts at New Energy Finance (among the world’s largest providers of clean energy industry analysis), total investment in renewable energy, energy efficiency, carbon capture, and storage projects could reach $270 billion annually by 2015 and $350 billion by 2020.

Of course, some investors are uncomfortable with the idea of investing in anything that relies on government support. But the truth is, all forms of power generation are heavily subsidized (either directly or indirectly). If that wasn’t the case, it would cost upwards of $13 for a gallon of 87 octane gasoline, and electricity bills would likely be triple what they are today. In other words, misconceptions about the energy industry should not prevent investors from profiting from the growth now taking place in the clean energy integration sector.

Charting the Growth

The projections for clean energy integration are breathtaking. While renewables have been consistently and aggressively growing over the past decade, their past growth pales in comparison to the future.

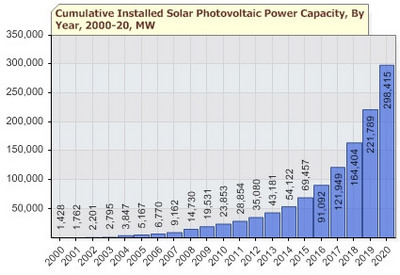

Cumulative installed solar photovoltaic power capacity has grown more than 900 percent, from just 1,428 megawatts in 2000 to 14,730 megawatts in 2008. By 2020, it’s expected to grow another 1,900 percent – reaching 298,415 megawatts.

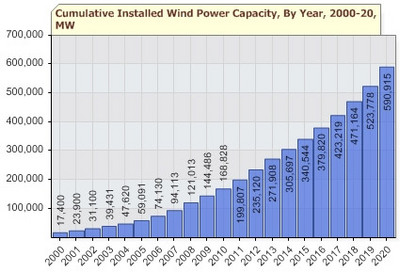

Cumulative installed wind power capacity has grown nearly 600 percent, from just 17,400 megawatts in 2000 to 121,013 megawatts in 2008. By 2020, it’s expected to grow another 388 percent – reaching 590,915 megawatts.

(Note: wind power capacity numbers from the World Wind Energy Association show 2008 installed capacity at 121,188 megawatts, and 2009 installed capacity at a projected 152,000 megawatts.)

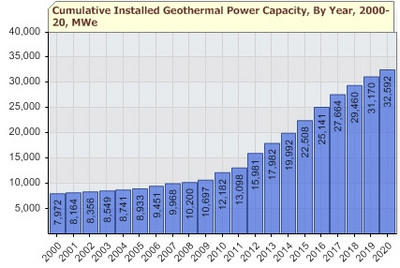

Cumulative installed geothermal power capacity has only grown 28 percent from just 7,972 megawatts in 2000 to 10,2000 megawatts in 2008. But by 2020, it’s expected to grow another 219 percent, reaching 32,592 megawatts.

As installed solar, wind, and geothermal power capacity continue to grow over the coming decades, infrastructure upgrades and smart grid technology should further facilitate this growth. From software and hardware to transformers and batteries, this “smart grid” market is projected to be huge. In fact, the American Society of Civil Engineers estimates that over $2 trillion will be spent on our electric infrastructure by 2030.

Investors looking for a way to play this angle are advised to watch three companies in particular: EnerNoc, Inc. (ENOC), Comverge, Inc. (COMV), and Itron Corporation (ITRI).

Biofuels

In the area of personal transportation, next-generation biofuels and electric vehicles will take over where oil leaves off. According to Clean Energy research, the global markets for biofuels are set to grow from $20.5 billion in 2006 to $80.9 billion by 2016.

But while traditional corn-based ethanol laid the early groundwork for integrating ethanol into America’s transportation fuel infrastructure, it will likely be cellulosic ethanol and algae, along with jatropha-based biodiesel, that take biofuels into the future.

Commercial availability for algae-based biodiesel is expected as soon as 2012, with an identifiable market impact beginning around 2016. But there are other exciting developments on the horizon.

Jatropha is a non-food crop plant that is resistant to drought and pests. It can grow on virtually barren land with little rainfall and can survive up to three years of consecutive drought. Countries that grow the jatropha plant are now cultivating it in record amounts in anticipation of its use as a viable feedstock for future biodiesel production. In India, about 11 million hectares of land have been slated for future jatropha plantations.

Plug-in Hybrids

While there is certainly robust growth potential in next-generation biofuel development, investors are increasingly bullish on electric and plug-in hybrid electric vehicles (PHEVs). Every major car manufacturer now has at least one new PHEV or electric vehicle in production.

Several start-ups and foreign competitors are entering the electric vehicle marketplace, too. Tesla Motors, a small California-based start-up, announced in July that it is now a profitable operation—earning $1 million on revenue of $20 million, even amidst a brutal recession. Tesla’s all-electric Tesla Roadster boasts a 240-mile all-electric range, and accelerates from 0 to 60 in 3.7 seconds.

BYD, a Chinese electric carmaker, was on the receiving end of a sizeable investment from legendary Berkshire Hathaway’s Warren Buffet last year. As is customary with Mr. Buffet, his investment is already turning a handsome profit. The “Oracle of Omaha” originally bought 225 million shares at HK$8. The shares trade today at HK$45

It’s also worth noting that the Obama Administration just earmarked up to $2.4 billion in stimulus grants to develop batteries, parts, and programs for electric cars.

For investors to capitalize on the PHEV market, industry analysts are pointing to the high-performance battery market. Several strong companies are already capitalizing on this development including Johnson Controls (JCI), and Ener1, Inc. (HEV). Another promising company, A123 Systems, is set to go public in the near future.

Putting Your Green to Work

Like it or not, we are entering a transitional energy economy. Supported by world governments and climate change initiatives, prioritized by rapid fossil fuel depletion, and facilitated by global investment —expected to reach $270 billion annually in about five years—the transformation of our energy economy is already yielding new ways for Americans to invest and build wealth.

Investors who choose to sit on the sidelines will gain nothing. But those who act now will be a part of one of the greatest investment opportunities of the 21st century.

Jeff Siegel is the editor of www.greenchipstocks.com and author of Investing in Renewable Energy: Making Money on Green Chip Stocks (Wiley 2008).

*Charts provided by GlobalData